How to get a GST Registration ?

You can register yourself under GST on government official website for GST gst.gov.in

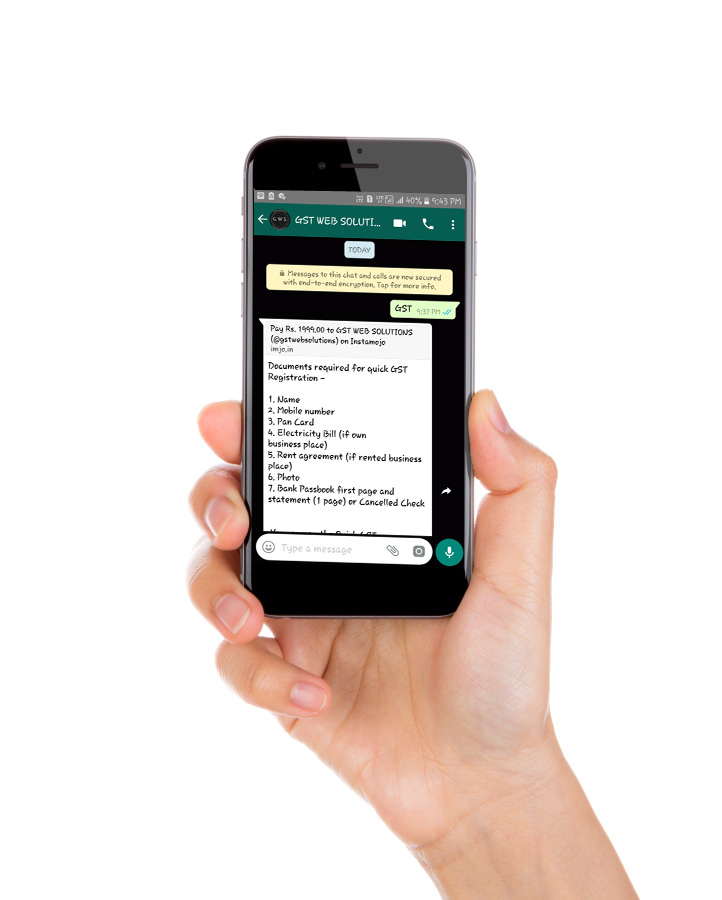

Alternatively, you can also take help of our GWS Quick GST Registration Service which you can access on whatsapp 24/7.

Just send 'GST' on +917007165869 using your Whatsapp number.